Benji Miller's Market Insights is a public resource created to share and inform market participants about the technical outlook of the markets with a focus on the precious metals. The author of this blog is an experienced and proven money manager, market technician, and trader. Benji Miller is an experienced Elliott Wave analyst/technician. Contact Benji at: (858) 663-5341 or benjimiller23@gmail.com

Friday, December 28, 2012

12/28: Silver Wheaton analysis/short-term prediction

Good morning,

Below is the same chart of Silver Wheaton that I posted on 12/24, along with arrows indicating my wave predictions for the next few weeks/months. I still anticipate a rally to resistance near $40, followed by a final selloff to approximately to the $32 support level to complete Wave 1 of Wave V (Elliottwave count).

I suggested the SLW $37 JAN Calls yesterday as a possible speculation and/or the stocks of Silver Wheaton, Silver Standard Resources, First Majestic Silver, SLV - the silver ETF, and AGQ - the leveraged silver ETF... as more conservative short-term silver investments on the potential rise over the next few weeks.

Below is the same chart of Silver Wheaton that I posted on 12/24, along with arrows indicating my wave predictions for the next few weeks/months. I still anticipate a rally to resistance near $40, followed by a final selloff to approximately to the $32 support level to complete Wave 1 of Wave V (Elliottwave count).

I suggested the SLW $37 JAN Calls yesterday as a possible speculation and/or the stocks of Silver Wheaton, Silver Standard Resources, First Majestic Silver, SLV - the silver ETF, and AGQ - the leveraged silver ETF... as more conservative short-term silver investments on the potential rise over the next few weeks.

Thursday, December 27, 2012

12/27: GDX update

Gold Miners ETF: 60-min interval update

GDX is exhibiting very positive/bullish price action with a nice break-through above the $45 level, confirming the bullish developments in gold & silver...

My short-term target for GDX is around $49.60, which is the 50% retracement from $54.69 back on September 21, and also happens to be where the downtrending resistance line would intersect the price (see the GDX daily chart from yesterday's post).

GDX is exhibiting very positive/bullish price action with a nice break-through above the $45 level, confirming the bullish developments in gold & silver...

My short-term target for GDX is around $49.60, which is the 50% retracement from $54.69 back on September 21, and also happens to be where the downtrending resistance line would intersect the price (see the GDX daily chart from yesterday's post).

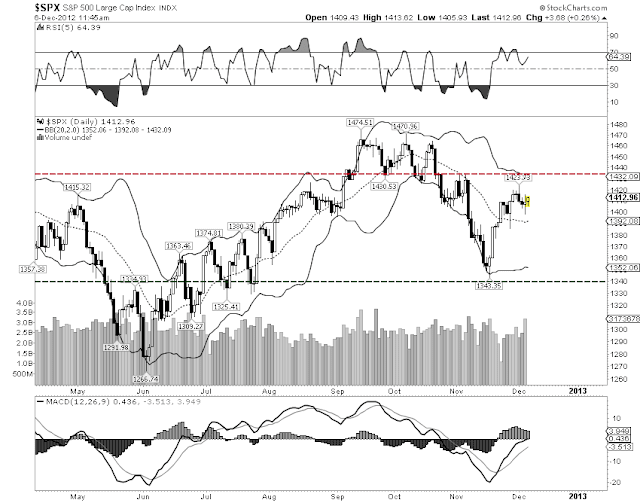

12/27: S&P 500 revisited

In my Dec. 18 S&P 500 update, I wrote the following:

"The S&P 500 has breached the upper Bollinger Band on the daily chart, which has generally been very strong resistance over the most recent rally (see previous highs on the chart below). This indicates that the broad market is very overbought short-term and is unlikely to continue higher until some of the recent gains have been digested..."

As it turns out, the close on Dec. 18 was $1,448.00 and was the recent high. We are now making our way towards the lower band...

"The S&P 500 has breached the upper Bollinger Band on the daily chart, which has generally been very strong resistance over the most recent rally (see previous highs on the chart below). This indicates that the broad market is very overbought short-term and is unlikely to continue higher until some of the recent gains have been digested..."

As it turns out, the close on Dec. 18 was $1,448.00 and was the recent high. We are now making our way towards the lower band...

Wednesday, December 26, 2012

12/26: Gold Miners ETF update

Gold Miners ETF (GDX) update:

The Gold Miners ETF (GDX) is giving us signals of a short-term low in gold, as well.

Short-term target: Wave (b)?

The Gold Miners ETF (GDX) is giving us signals of a short-term low in gold, as well.

- we can see that GDX is stabilizing at the strong green support trendline, as well as, the purple support trendline;

- both RSI and MACD have been diverging AND climbing over the past month of price declines;

- the declines in GDX from the Wave (X) high have been successive in threes, indicating that the decline is NOT impulsive but merely corrective.

Short-term target: Wave (b)?

12/26: Gold update

GOLD update:

My Elliottwave count indicates that Gold is still consolidating in Wave 4 combination and should be complete once the final diagonal ends near the projected Wave (e)/ Wave Y/ Wave IV level, possibly in Jan/Feb of 2013. This pre-supposes an initial rally to set Wave (d), of course, in the next few weeks.

Bullish short-term indicators:

1) gold is holding at the lower bollinger band,

2) 200 day MA may soon be recaptured at $1,662, and

3) RSI and MACD are oversold

Monday, December 24, 2012

12/24: Silver Wheaton - 1.5 year chart

Today's posting is a 1.5-year chart of Silver Wheaton and I believe this chart best illustrates what we can expect from the stock in the coming weeks. As you can see, there is a clear support trendline (green) which goes back to October of 2011... and my premise is that SLW needs to test this support trendline before a new breakout ensues.

In the short-term, however, I still anticipate that SLW will rally to test the red resistance trendline (peaking around $40) in the coming weeks. I believe this is the case because many of the short-term indicators are strongly oversold and because my Elliottwave count on SLW suggests that we need another X wave before a final Y wave down to test support.

Finally, please note that there are 2 corroborating indicators (aside from the green support trendline) which lead me to anticipate a final low near $32:

1] the 200-day moving average for SLW is currently at $32.35; and

2] the 50% retracement from the $22.74 low in May of this year is at $31.77

Both of these target are pulling SLW down, but in a very erratic fashion...

Bottom line: My intuition, my Elliottwave count, and various traditional technical indicators on SLW lead me to the above analysis/wave predictions and we will very soon see if these assumptions are correct.

Thursday, December 20, 2012

12/20 - SLW update (critical support holding)

Once again, I admit that I was premature in calling for a bottom on Silver and Silver Wheaton yesterday... however, we now have several indications that a bottom may finally be in and that we are next going to attack the red resistance trendline near $39.50-$40.00 (marked Wave X).

Key support/bottom indicators:

a) the bears tried to take SLW below the key $34.71/$34.79 level but the stock has rallied to close ABOVE that level.

b) SLW has also closed above the declining green support trendline; and

c) the low band on the DAILY Bollinger Bands is $34.78, which has held today.

I expect the next week or so to be very strong for SLW...

Key support/bottom indicators:

a) the bears tried to take SLW below the key $34.71/$34.79 level but the stock has rallied to close ABOVE that level.

b) SLW has also closed above the declining green support trendline; and

c) the low band on the DAILY Bollinger Bands is $34.78, which has held today.

I expect the next week or so to be very strong for SLW...

Wednesday, December 19, 2012

12/19 - SLW update: short-term low set?

With regard to Silver Wheaton, I was clearly premature yesterday in calling for a low...

However, having now noticed the parallel channel that has formed (purple lines) with Waves a, b, c, and d, I now believe a low is in and I expect that we proceed higher to test the red resistance trendline (marked Wave e/X).

I still anticipate that SLW will not be able to re-capture the resistance trendline and that the stock will subsequently fall to a final low near $32 in early January.

However, having now noticed the parallel channel that has formed (purple lines) with Waves a, b, c, and d, I now believe a low is in and I expect that we proceed higher to test the red resistance trendline (marked Wave e/X).

I still anticipate that SLW will not be able to re-capture the resistance trendline and that the stock will subsequently fall to a final low near $32 in early January.

Tuesday, December 18, 2012

12/18 - S&P 500 update: Bollinger Bands indicate short-term high

The S&P 500 has breached the upper Bollinger Band on the daily chart, which has generally been very strong resistance over the most recent rally (see previous highs on the chart below). This indicates that the broad market is very overbought short-term and is unlikely to continue higher until some of the recent gains have been digested...

12/18: SLW update

Silver Wheaton has sold off sharply today along with silver and the precious metals complex, however, my short-term target is still the red rising resistance trendline.

I believe SLW is bottoming here (Wave d) and will make its way up to resistance in the coming trading days (near the Wave e/X label around $39-$39.50).

I believe SLW is bottoming here (Wave d) and will make its way up to resistance in the coming trading days (near the Wave e/X label around $39-$39.50).

Silver/SLV update and GDX etf

Silver/SLV has sold off this morning but has held at key support of $30.53.

My Elliottwave count still indicates that we need a Y wave above $33.10 before we see a final sell-off near $28-$29. RSI and MACD are severely oversold and also indicate a short-term low.

GDX (Gold Miners ETF): short-term, I believe the precious metals complex is bottoming and the GDX etf appears to be sending confirmation of such. Notice that we have 3 lows at the low $45 level and its appears to be an inverted head & shoulders formation. I expect GDX will rally to near the $48.50 level (which is also where downtrend resistance lies) and FAIL there. Thereafter, I do expect another sell-off to new lows... probably after New Year's.

Monday, December 17, 2012

12/17: First Majestic Silver Corp. (AG)

First Majestic Silver Corp. (FR on the TSX; AG on the NYSE) is another well-positioned junior silver mining company that is well-leveraged to the coming price rise in Silver. I've been following the company for several years and I believe that I have a good sense for the stock's Elliott Wave count.

As you can see from the 2 charts below, the weekly chart shows the secular trend for First Majestic since the 2003 low and it appears we completed Wave IV in the summer of this year, consistent with the Wave IV lows in SILVER and Silver Wheaton this summer.

The daily chart now shows First Majestic's daily pattern (NYSE listing) since the Wave IV low in May and this count seems to show that we have completed Wave (3) of Wave V but have not yet set a Wave (4) low. To me, it appears that Wave (4) is still in process in the form of an expanding triangle and, if so, we should see one more new incremental high above $24.20 [Wave (d)] in First Majestic and then an incremental new low below $20.41 [Wave (e)] before we bottom and Wave (5) of V commences...

I purchased 1,000 shares of AG this morning at $21.25 in my CBOE paperTrade account in hopes of a short-term trade to Wave (d). The stock has sold off strongly in early morning trading due to the announcement of its acquisition of Orko Silver.

As you can see from the 2 charts below, the weekly chart shows the secular trend for First Majestic since the 2003 low and it appears we completed Wave IV in the summer of this year, consistent with the Wave IV lows in SILVER and Silver Wheaton this summer.

The daily chart now shows First Majestic's daily pattern (NYSE listing) since the Wave IV low in May and this count seems to show that we have completed Wave (3) of Wave V but have not yet set a Wave (4) low. To me, it appears that Wave (4) is still in process in the form of an expanding triangle and, if so, we should see one more new incremental high above $24.20 [Wave (d)] in First Majestic and then an incremental new low below $20.41 [Wave (e)] before we bottom and Wave (5) of V commences...

I purchased 1,000 shares of AG this morning at $21.25 in my CBOE paperTrade account in hopes of a short-term trade to Wave (d). The stock has sold off strongly in early morning trading due to the announcement of its acquisition of Orko Silver.

Friday, December 14, 2012

12/14: Silver/SLW correlation comparison

Today, I would like to compare 2-year charts for Silver and Silver Wheaton (SLW) - whose Elliott Wave counts show Wave 4/Wave (4) consolidations complete as of this summer.

My counts for both also show that Wave (i) for Silver and Wave (1) for Silver Wheaton have been set at the most recent highs in September/October and that we are now working on establishing their respective Wave (ii), Wave (2) lows.

My premise with Silver is that the Wave (ii) low will likely occur within the next month when it falls to test the declining green support trendline.

My premise with SLW, below, is that we see an attack on the red resistance trendline in the coming days... fail to breach that resistance level... and then fall (along with Silver) to test the green support trendline (and the 200-day moving average) near $32, in January.

My counts for both also show that Wave (i) for Silver and Wave (1) for Silver Wheaton have been set at the most recent highs in September/October and that we are now working on establishing their respective Wave (ii), Wave (2) lows.

My premise with Silver is that the Wave (ii) low will likely occur within the next month when it falls to test the declining green support trendline.

My premise with SLW, below, is that we see an attack on the red resistance trendline in the coming days... fail to breach that resistance level... and then fall (along with Silver) to test the green support trendline (and the 200-day moving average) near $32, in January.

Thursday, December 13, 2012

Wednesday, December 12, 2012

12/12 - SLW hits first level of resistance; SOLD all long speculative positions in paperTrading account.

Silver Wheaton hit the first major resistance level in today's afternoon trading.

As you can see from previous posts below, I had inserted a horizontal resistance line at $38.33 to notate this first level of resistance (which also happens to be the 50-day MA on the daily chart, namely $38.21).

I still expect SLW to attack the RED resistance trendline in the coming days, but to fail and then eventually fall to a Wave (II) low near $32.

As you can see from previous posts below, I had inserted a horizontal resistance line at $38.33 to notate this first level of resistance (which also happens to be the 50-day MA on the daily chart, namely $38.21).

I still expect SLW to attack the RED resistance trendline in the coming days, but to fail and then eventually fall to a Wave (II) low near $32.

12/12 - SLW climbing towards resistance

Silver Wheaton (SLW) is making its way upward towards the RED resistance trendline..

I would not be surprised to see a very strong attack on the line (and perhaps a temporary piercing of the line), however, I do expect this attack to fail. If the attack does fail, my next target for SLW is the $32 level... where I am projecting an important Wave (II) low and the beginning of Wave (III) in SLW, which should take the stock to new all-time highs.

I would not be surprised to see a very strong attack on the line (and perhaps a temporary piercing of the line), however, I do expect this attack to fail. If the attack does fail, my next target for SLW is the $32 level... where I am projecting an important Wave (II) low and the beginning of Wave (III) in SLW, which should take the stock to new all-time highs.

Friday, December 7, 2012

12/7 - Elliott Wave counts on SLW

The charts below illustrate my Elliott Wave counts on Silver Wheaton.

First, a 2-year chart showing SLW's Wave 4 consolidation Triangle or Combination, which bottomed in May of this year. We see a Wave (1) high near $40 and I believe we are now in a W-X-Y-X-Z combination for Wave (2). My projected low for Wave (2) is showing clustering targets near $32 (near the 50% retracement and the green support trendline). I project Wave (3) to commence from that area after a bottom is set and we see a clear 5- wave thrust upward.

The chart below shows Silver Wheaton's entire bull market run thus far. Note that the chart is Silver Wheaton's TSX listing (because there was no NYSE listing before 2005). Aside from my wave count, there are 3 noteworthy indications that SLW is soon to see new highs:

a. the consolidation from the 2011 high is clearly choppy/sideways-downwards (indicative of consolidations rather than a motive wave starting an extended decline).

b. RSI appears to have bottomed near the 50 support level; and

c. the MACD is coming off severe lows and seems poised to achieve a bullish crossover.

12/7 - initiated CBOE paperTrade account

Benji Miller's CBOE paperTrade account; setup: 12/7/2012

Initial account value: $100,000

Speculative Precious Metals Sector Fund

12/7/2012 initiated trades:

a. GDX: 500 shares bought at $45.99

b. SLW: 500 shares bought at $35.54

c. SSRI: 1,000 shares bought at $13.96

d. SLW Option Dec 2012 $37 CALL: bought 250 @ $0.37

e. SLW Option Jan 2012 $37 CALL: bought 100 @ $1.03

Initial account value: $100,000

Speculative Precious Metals Sector Fund

12/7/2012 initiated trades:

a. GDX: 500 shares bought at $45.99

b. SLW: 500 shares bought at $35.54

c. SSRI: 1,000 shares bought at $13.96

d. SLW Option Dec 2012 $37 CALL: bought 250 @ $0.37

e. SLW Option Jan 2012 $37 CALL: bought 100 @ $1.03

12/7 SLW update

Silver Wheaton held support yesterday and is rallying strongly this morning above the important green support trendline. As mentioned previously, I expect SLW to reach the red resistance trendline near $39 (Marked X) in the coming week(s) before falling to the $32 for a final Wave (2) low.

I setup a paperTrade account with the CBOE this morning for the purpose of establishing a track record. I initiated several position, which will be posted shortly.

I setup a paperTrade account with the CBOE this morning for the purpose of establishing a track record. I initiated several position, which will be posted shortly.

Thursday, December 6, 2012

12/6 - S&P500 update

I expect the S&P 500 to climb in the coming week and attack the 1,430 resistance area (which also happens to be the higher band resistance area for the Bollinger Bands)... yet I predict that the index will not be able to meaningfully break through and will subsequently fall and re-test the November low near $1,343 (which is also the lower band support for the Bollinger Bands).

12/6 - SLW update

Silver Wheaton bears attempted an attack on the recent low of $34.71 but the level held and SLW is now in process of recapturing the green support trendline (see chart). I expect the coming bounce in SLW to reach the red upward trending resistance level near $39. Thereafter, I anticipate that SLW will fall to the $32 level (along with the Silver decline projected to bottom near $28.50).

Wednesday, December 5, 2012

Dec. 5, 2012 - 10:25 am - Chicago

Silver appears to have completed a wave D correction this morning and I believe is poised to rise in the coming days and test the recent high at $35.44

My favorite trade proxy for Silver is Silver Wheaton (SLW), which I believe is also bottoming in the low $35 range and I expect it to rally to the high $38/low $39 level before a final corrective decline ensues for Wave 2 in its upward trend.

I currently have a target of $32 for the final wave down... as there are several converging indicators of support there:

a) the 50% fibonacci retracement for Wave 1 is $31.78

b) the rising trendline on the weekly chart for SLW intersects near $32; and

c) because Silver is due to sell-off soon and test the declining support trendline of the past 2 years (near $28), SLW ought to get sold off rather dramatically if that should occur.

d) SLW's 200-day Moving Average is slightly above $32 at $32.43.

Benji Miller

Silver appears to have completed a wave D correction this morning and I believe is poised to rise in the coming days and test the recent high at $35.44

My favorite trade proxy for Silver is Silver Wheaton (SLW), which I believe is also bottoming in the low $35 range and I expect it to rally to the high $38/low $39 level before a final corrective decline ensues for Wave 2 in its upward trend.

I currently have a target of $32 for the final wave down... as there are several converging indicators of support there:

a) the 50% fibonacci retracement for Wave 1 is $31.78

b) the rising trendline on the weekly chart for SLW intersects near $32; and

c) because Silver is due to sell-off soon and test the declining support trendline of the past 2 years (near $28), SLW ought to get sold off rather dramatically if that should occur.

d) SLW's 200-day Moving Average is slightly above $32 at $32.43.

Benji Miller

Subscribe to:

Posts (Atom)

+TRIANGLE.png)